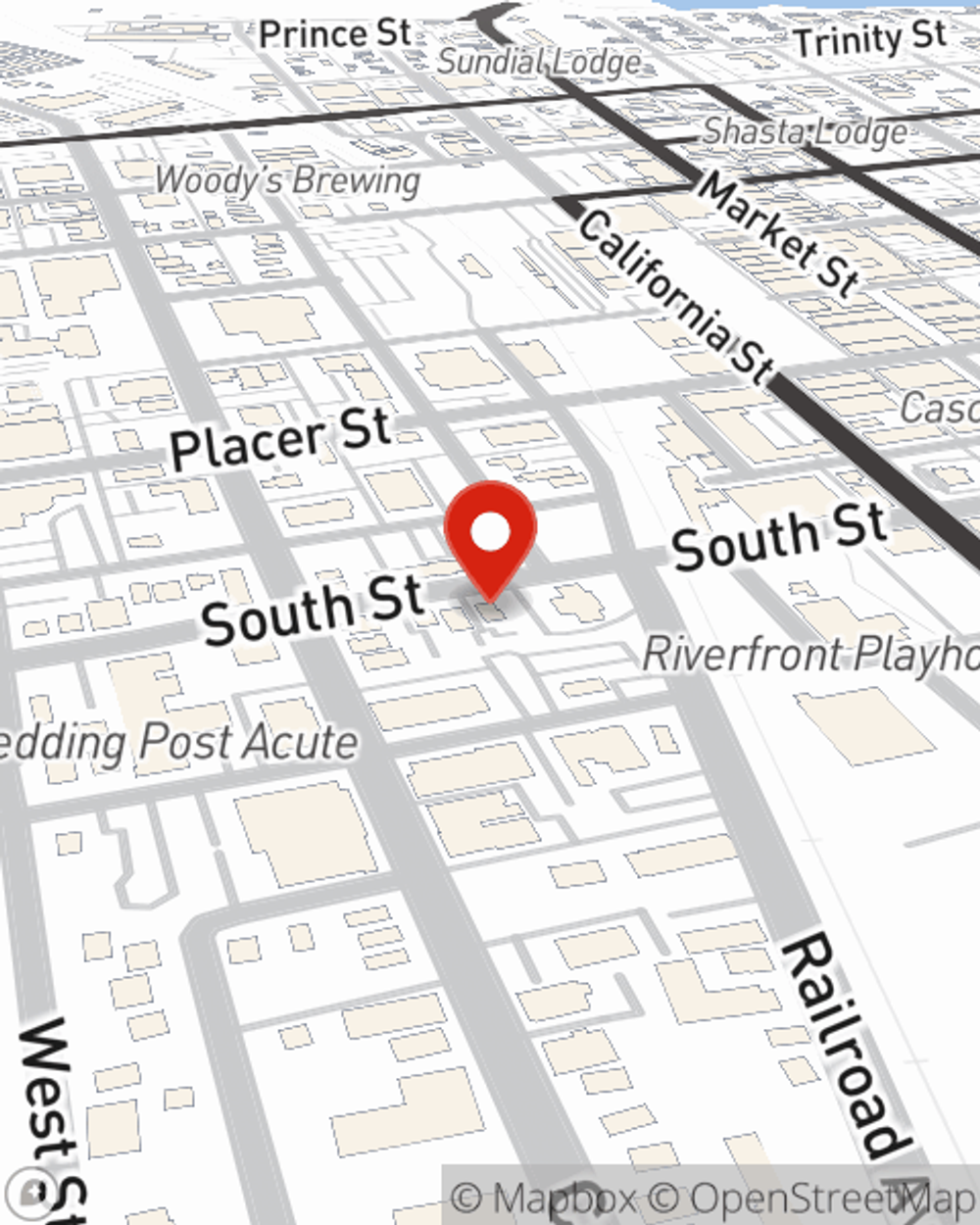

Life Insurance in and around Redding

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

The common cost of funerals in this country is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your loved ones to pay for your funeral as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help the ones you leave behind afford funeral arrangements and not experience financial hardship.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Why Redding Chooses State Farm

And State Farm Agent Dee Stover is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Simply call or email State Farm agent Dee Stover's office today to check out how a State Farm policy can work for you.

Have More Questions About Life Insurance?

Call Dee at (530) 241-0252 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.